Abstract

Core Contributors of the stake.link DAO propose migrating liquidity and incentives from the current, older stLINK/LINK StableSwap Curve Pool (version 0.2.15) to a newer design stLINK / LINK StableSwap-NG Curve Pool. This strategic move will leverage the advanced features of Curve NG combined with setting optimized parameters with the help of LlamaRisk, to enhance the health of secondary markets, ensuring readily available redemption liquidity, and paving the way for future lending capabilities, potentially through a Curve Lend market and a potential listing on Aave. This upgrade aligns stake.link with the trajectory of leading ETH-based LSTs like stETH and pxETH and was strongly suggested by third parties while evaluating the possibility to add wstLINK as collateral in DeFi.

Rationale

The current older Curve Pool Design, while functional, presents limitations in terms of trading efficiency. Upgrading to a StableSwap-NG Curve Pool offers several key advantages which are detailed here:

- Improved Health for Secondary Markets: LlamaRisk will provide parameter recommendations, optimized for improving the health of secondary markets. This is crucial for ensuring readily available redemption liquidity, meaning as much LINK as possible for stLINK → LINK swaps, ideally aiming for a 50:50 balance. This focus on redemption liquidity is essential for a smooth user experience, mirroring the performance of successful ETH-based LSTs, and is a key requirement for a successful Aave listing. It also supports liquidations and overall market stability.

- Potential Facilitation of Lending: The StableSwap-NG Curve Pool architecture simplifies the setup of a Curve Lend market, opening up exciting new possibilities for stake.link users. This will enable borrowing against wstLINK and further enhance its utility within the DeFi ecosystem.

- Alignment with Leading LSTs: This migration positions stake.link alongside other prominent LSTs, adopting best practices and ensuring compatibility with evolving DeFi standards.

Specification

- Migration of Liquidity: All liquidity from the current, older stLINK/LINK StableSwap Curve Pool (version 0.2.15) with address 0x1c899ded01954d0959e034b62a728e7febe593b0) should be migrated to the new StableSwap-NG Curve Pool.

- Parameter Optimization: LlamaRisk will provide recommendations for optimal pool parameters, focusing on maximizing readily available secondary redemption liquidity. These parameters will be designed to maintain a healthy balance of LINK in the pool and align with successful ETH-based LST strategies.

- Migrated Incentive Structure: The migrated incentive structure for the new StableSwap-NG Curve Pool will remain the same as last determined in SLURP-31.

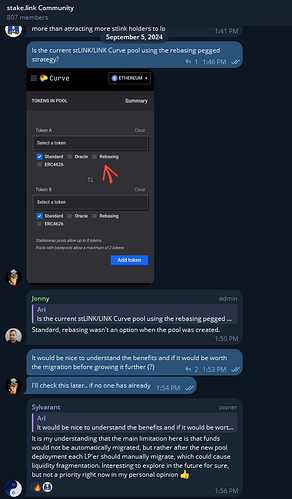

- Oracle Considerations: The new pool will leverage the enhanced capabilities of StableSwap-NG Curve Pools, which includes a more robust framework for oracle integration across lending venues like Euler. Further details regarding specific oracle implementations will be explored and communicated as needed.

Conclusion

SLURP-37 represents a significant step forward for stake.link, enhancing its infrastructure and positioning it for future growth. By migrating to a StableSwap-NG Curve Pool, we improve trading efficiency, and unlock the potential for lending capabilities. This move not only strengthens stake.link’s position in the LST landscape but also creates new opportunities for users and the DAO. We encourage community discussion and feedback on this proposal. We believe this upgrade is crucial for long-term success and will solidify stake.link’s role as a leading LINK LST protocol.

ADDENDUM: LlamaRisk just published their analysis and recommendations over at [Analysis] stLINK/LINK-ng Pool Optimization - Proposals - Curve.fi Governance