Abstract

This proposal seeks to establish a structured annual discretionary budget for the stake.link DAO, allowing for efficient operational management, competitive hiring, and streamlined financial oversight. The budget will come with financial oversight and execution facilitated by Harris & Trotter (H&T) as the designated custodian. Due to subjective token prices the budgeting and value of the treasury as well as payout for some items cannot be determined with full accuracy. Therefore, this budget has to withstand certain uncertainties and might need intervention at a later stage.

Please note that some of the items in this budget have already been approved by the DAO (SLURP-21, SLURP-23, SLURP-24, SLURP-30) and are included here for the purpose of streamlining and providing a comprehensive budget overview.

In total we are looking at $696,00 at current price levels to be paid in SDL and $323,450 to be paid in Cash / Stables. However, both of these numbers could be lower significantly over the year depending on the implementation of PoL for incentives, seeking community grants covering audit and development cost as well as no bug bounties needed to be paid out ($110,000 alone). Should the treasury experience a shortage of Cash / Stables we would take the decision on how to proceed to governance.

The primary objectives of this and future budget proposals include:

- Allocating a structured discretionary budget in SDL & USDC, providing operational flexibility while maintaining DAO accountability.

- Defining core budget categories to align with DAO priorities, including staffing, development, marketing, security, and strategic growth initiatives.

- Securing and formalizing funding for strategic hires, ensuring compensation remains competitive and is managed transparently but discreetly.

1. Motivation & Rationale

The stake.link DAO has grown significantly, requiring a more structured approach to financial management to support scalability, operational efficiency, and strategic expansion.

Key pain points that this proposal addresses:

-

Inefficiencies & compensation concerns: Without a structured budget, every expense requires public DAO governance approval, which risks delays, unnecessary scrutiny, and reduced competitiveness when operating.

-

Financial predictability: A defined yearly budget ensures stable funding allocation, avoiding ad-hoc funding requests that slow down execution.

-

Confidentiality in staffing matters: The DAO needs the ability to allocate salaries and compensation without publicly disclosing individual pay.

By creating a pre-approved budget, the DAO empowers the Council to act swiftly within predefined financial limits, while maintaining transparency and accountability through H&T’s financial oversight.

2. Stake.link DAO Budget Framework

2.a. Operating Expenses (OpEx):

These are the recurring, fixed costs necessary to maintain daily operations, governance, legal compliance, and infrastructure. This category is predictable, covering the core functions of the organization.

2.a.1. Governance, Staff & Administrative Expenses - $116,600/year

- Council Compensation: Fixed monthly payments to council members

- $24,000/year in SDL ($1,000/month for each of the two Community Council Members) - 50,000 SDL

- DAO Employee Compensation: Fixed monthly payments to DAO Employees

- $36,000/year in SDL ($3,000/month for one DAO Employee) - 80,000 SDL (SLURP-23)

- Legal & Compliance Fees: Retainers for legal counsel, compliance audits, regulatory advisory (SLURP-30)

- $31,600/year director and compliance fees for Little Bay Directors Limited billed quarterly $7,900/quarter

- $25,000/year registered agent, registered office, Nominee Guarantee Member, Service and Director Fees

2.a.2. Accounting & Financial Operations - approx. $91,000/year and subject to currency exchange

- Professional Accounting Services: Ongoing services provided by Harris & Trotter (SLURP-24)

- Fixed Costs: £60,000/year (core financial services)

- Estimated Variable Costs: £10,000–£30,000/year (depending on DAO growth and additional service demands)

2.a.3. Security Subscription Services - $52,450/year

stake.link works with immunefi.com as a bug bounty platform and Hypernative Labs for real-time monitoring of stake.link smart contracts. Both are important parts of stake.link security which incentivize security researchers to submit vulnerabilities to stake.link instead of black market, and for 24/7/365 continuous protocol monitoring. Both programs cover smart contracts and apps, and focus on preventing loss of user funds, denial of service, governance hijacks, data breaches, and data leaks.

- immunefi.com (SLURP-39)

- $27,450 USDC/year

- Hypernative Labs (SLURP-21)

- $25,000 USDC/year

2.a.4. Software Subscription Services / Fees - $5,000/year

- Retainer for cost incurred by Slack, Google Suite, Gnosis Safe, Snapshot

2.b. Strategic Investments (CapEx):

These represent project-based initiatives or departments focused on growth, research, and protocol development. Unlike OpEx, these can vary based on the DAO’s priorities and strategic goals for the year.

2.b.1. Business Development & Marketing - $35,000/year

The Business Development unit works to expand the penetration of stake.link’s staked assets across the Decentralized Finance ecosystem through integrations business development, tactical initiatives that increase stake.link’s network effects and increase stake.link’s staked capital base, protocol expansion, tradfi/CEX integrations, and generally maintaining relationships with partners and community stakeholders on an ongoing basis.

- Strategic Sponsorships $5,000: E.g., ongoing partnerships with @CCIPMetrics

- Travel and conference expenses $30,000

- Staking Rewards Summit 2025 $10,000

- SmartCon 2025 $20,000

2.b.2. Security Services - up to $140,000 depending on bug-bounty

- Immunefi: Up to $110,000 depending on severity of found bug (low to critical)

- Audit cost: $30,000 per LST voted positively by governance and not reimbursed by grants

2.b.3. DeFi Liquidity & Incentives Workstream - up to 1.3M SDL

- Uniswap - $400K~ TVL, targeting up to 5% SDL APY: 50,000 SDL

- Curve $9M~ TVL, targeting up to 5% SDL APY: 1M SDL

- Potential Future DeFi integration: 250K SDL

2.b.4. Talent Acquisition & Contributor Development Workstream - Budget TBD

- Recruitment Costs: For onboarding new contributors

2. Summary

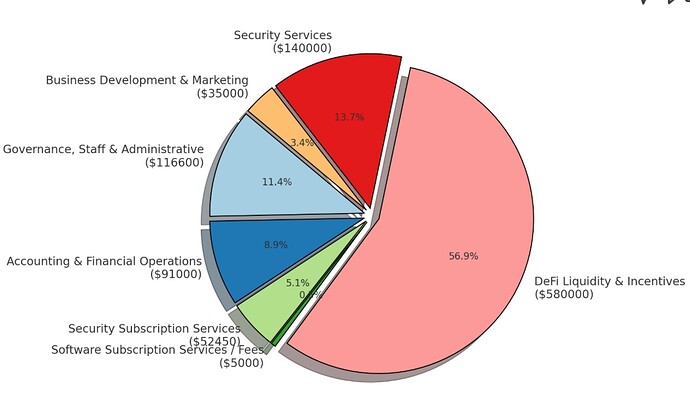

| Category | Amount (USD/Year) | Payment in Cash/Stables vs. SDL |

|---|---|---|

| 2.a. Operational Expenses (OpEx) | $265,050 | |

| 1. Governance, Staff & Administrative Expenses | $116,600 | SDL (subject to SDL price) |

| 2. Accounting & Financial Operations | $91,000 | Cash/Stables |

| 3. Security Subscription Services | $52,450 | Cash/Stables |

| 4. Software Subscription Services / Fees | $5,000 | Cash/Stables |

| 2.b. Strategic Investments (CapEx) | $755,000 | |

| 1. DeFi Liquidity & Incentives Workstream | $580,000 | SDL (subject to targeted reward rate) |

| 2. Security Services | $140,000 | Cash Stables (subject to bugs identified) |

| 3. Business Development & Marketing | $35,000 | Cash/Stables |

3. Conclusion & Next Steps

This proposal establishes a clear, structured approach to DAO financial management, ensuring:

- Faster decision-making and hiring processes

- Operational flexibility without governance bottlenecks

- Competitive salaries and staffing confidentiality

- Financial security and treasury oversight

By approving this budget framework, the stake.link DAO can scale efficiently while preserving governance integrity and operational transparency.

Next Steps:

-

Community Discussion & Feedback (7-14 days)

-

Formal Governance Vote

-

Budget Execution & Treasury Allocation via H&T

We invite all parties to the DAO to review and provide feedback before submitting this proposal for a governance vote.